UCC Article 9 for Dummies

Graduate School of Credit and Financial Management

By: Christen Borman, Douglas Jacobson, Jovan Rosa, Rocky Thomas, Susan Thomas, and Melvin Ucelo

Introduction

“Risk comes from not knowing what you’re doing”

-Warren Buffett

As a credit manager in the world of business to business (B2B) commerce, it is your job to facilitate sales while managing the risk associated with the extension of credit and protecting your company’s investment in accounts receivable. Trade credit is essential to the accommodation of sales growth and, as we know, there is always some risk associated with the extension of credit. Unfortunately, as B2B creditors, we often don’t have the luxury of requiring collateral to extend credit. The prudent and risk free approach would be to require payment at the time of the transaction. However, the last we checked, our companies have sales growth, increased market share and profitability as their core goals. In a competitive environment, it is essential that we find ways to efficiently leverage the extension of credit to accommodate these goals.

The good news is that there are laws and regulations that provide protection for B2B creditors and give us legal remedies to help mitigate the risk that comes with the extension of trade credit. It is called the Uniform Commercial Code (UCC). The bad news is that most of us are not legal experts and it can be a daunting task to research and understand the UCC. We are hopeful that “UCC Article 9 for Dummies” will provide a quick guide to help the commercial creditor take advantage of the tools available to successfully secure their accounts receivable.

Legal codes and laws are not an easy subject to understand. The Uniform Commercial Code contains the legal framework that governs commercial business transactions. The articles of the UCC are a set of laws governing the sale of goods, leases, negotiable instruments, bank deposits, funds transfers, letter of credit, bulk transfers, bulk sales, warehouse receipts, bills of lading, investment securities and secured transactions. Within the code one of the most important articles is Article 9, Secured Transactions, which provides the governing rules for any transaction that combines a debt with a creditor’s interest in a debtor’s personal property. In 1998 revisions to Article 9 were completed and were approved by all fifty states by 2001. Article 9 provides a detailed instruction manual on steps to take to legally protect a debt by staking a claim in the debtor’s property.

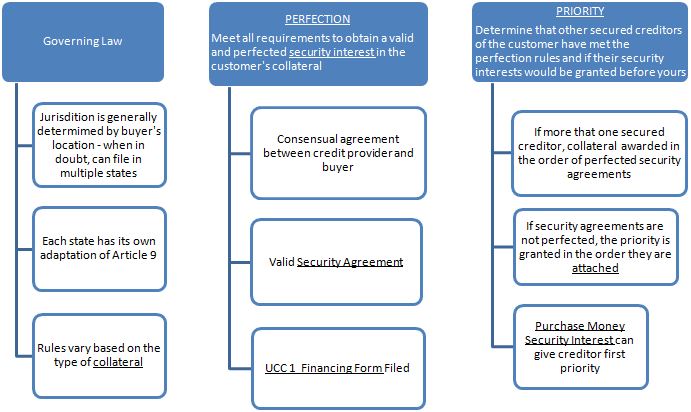

The understanding and use of the basic elements of a secured transaction in Article 9 can be a daunting task. It requires a thorough understanding of the code and any new amendments. A creditor must be able to follow the process, comprehend the scheme and implement a solution that best fits the purpose of mitigating the risk. In most scenarios, the creditor can gain superior bargaining power by requiring the debtor to provide a security interest to the creditor as part of the transaction. This is done before granting a loan or providing something of value in order to maximize the likelihood of payment in the event that the debtor does not comply with the terms of the agreement. The creditor can exercise its rights created under Article 9. For this to be successful it is important to create an enforceable security interest “Attachment”, protect the security interest from claims of other parties to the collateral “Perfection”, and have the highest “Priority”.

As part of the process, it is always important that the choice of law and the parties’ jurisdiction is well defined in order to enforce rights with no delay. This usually is where the debtor is. Complications arise from the need to understand the common legal definitions used throughout article’s many sections, the fact that its rules have exceptions that a credit manager needs to understand, and that timing of actions and the specificity of documentation, if not followed, will endanger the legal protection the creditor seeks.

UCC Article 9 for Dummies is here to decode and help explain from a credit manager’s perspective, the more relevant aspects of the article and demystify the relevant aspects so we know what to do when it is required to secure a transaction. It’s meant to give a high level view of the code and to highlight the riskier areas. A credit manager should always seek advice from legal counsel regarding specific questions of law, especially if the monetary exposure is large.

Article 9-Secured Transactions

Overview

The credit manager must ensure that all requirements of Article 9 are properly met and documented to obtain a legal claim in a debtor’s collateral if the debtor does not pay or satisfy its obligations. The credit manager must then take the steps necessary to insure that the legal claim established has priority over other creditors.

The illustration below attempts to capture the main areas of the code that a credit manager must be familiar with to protect his or her company’s financial exposure to a non-paying customer. Definitions of underlined terms are summarized in the glossary.

The main point of Article 9 is to be a secured creditor:

If a creditor is secured it has a claim in something of the buyer’s (the goods exchanged for future payment or other collateral). This gives the creditor:

- Right of repossession of goods extended in exchange for future payment if the payment is never made

- Elevated priority in the potential proceeds? Even if the buyer is filing bankruptcy

- It upholds defense to preference in the potential instance of a bankruptcy filing.

However, a creditor cannot be secured or have the claim in the asset until its interest is perfected.

What is a security interest?

A security interest is an interest in the asset of a buyer. This is important for creditors to leverage their position of being able to fully collect money extended to buyers.

A blanket interest securitization can be made and is often the case with banks that have an interest in all applicable assets of a buyer (except for some real property, aircraft, ships and motor vehicles). A Purchase Money Security Interest (“PMSI”) is applicable when the buyer takes possession of the goods from the creditor and it allows the creditor to seek a super-priority security interest, putting them above all other secured creditors in security ranking. PMSI filings are the only ones that require notification to other secured creditors of the filing since it gives that creditor super-priority interest.

What is collateral and why is it needed in a security interest?

The asset (collateral) in a security interest must be personal property but cannot be real property, aircraft, ships or motor vehicles.

Typical collateral involved in a security interest:

- Inventory

- Fixtures

- Equipment

- Vehicles

- Accounts receivable

- Stocks, bonds and negotiable instruments

Essentially, the collateral acts as the proceeds to which the security interest attaches. The common types of collateral in a security interest are blanket, consignment, or specifically listing the assets or a Purchase Money Security Interest.

It is imperative that a secured party handles collateral with care. The following case is an example of a creditor’s breach of this duty.

Collateral—Must handle with care!

United States v. Baus The secured party neglected to take proper care of collateral consisting of debtor’s plant, machinery, equipment and inventory located in Puerto Rico by leaving it in an unsecured warehouse for two years. Theft and vandalism caused the sale of the remaining inventory to be delayed and led to an 88 percent decline in the value. The $100,000 of the debtor’s inventory netted just $12,131 after the expenses of the sale were taken out. The First Circuit found it “likely” that the government guarantor had breached its duties under Section 9-207

Who is responsible for taking care of the collateral?

Practical expenses incurred in ensuring the proper care of collateral are chargeable to the debtor and secured on the collateral. An example would be the cost of insurance. If the goods are accidentally lost or damaged any shortfall in the insurance rests on the debtor. Payment of taxes and other charges directly related to the preservation, custody, or operation of collateral also fall under this category.

Collateral in Action—Use it don’t lose it!

Collateral Description Errors causing failure to perfect

1st Source Bank vs. Wilson Bank & Trust (Tennessee)

The US Court of Appeals for the Sixth Circuit ruled that a creditor bank did not have a perfected security interest in the debtor’s accounts receivable because “the bank failed to include ‘accounts’ or ‘accounts receivable’ as part of the bank’s collateral in its UCC financing statement” even though those words were used in the security agreement.

Ref: source: Business Credit Magazine, May 2014 – “Mistakes in a UCC Financing Statement’s Collateral Description

Can Be Hazardous to a Perfected Security Interest!”

So now I have an interest in the collateral of my buyer - what do I do next?

So now I have an interest in the collateral of my buyer - what do I do next?

File a security agreement!

The security agreement indicates the creditor’s right to file a security interest in the specifically named assets of the buyer, which acts as the collateral to uphold the agreement. In order for a creditor to have a valid security interest the agreement must be signed (authenticated) by both the creditor and the buyer, contain a description of the collateral, and make it clear that the security interest is intended.

Why are people telling me I need to be perfect in this process?

Why are people telling me I need to be perfect in this process?

What is perfection in a security interest?

Perfection is when the creditor has filed their security agreement between them and the buyer. It is filed with the secretary of the state that the buyer is registered as a business entity in (or resides in if a sole proprietor). If the buyer is registered in multiple states, multiple security interests can be filed per state. If you don’t file your security agreement, you don’t have your security interest and you don’t have any secured rights in your buyer’s collateral. This would mean…You aren’t perfect!

Importance of Perfection!

Debtor Name Errors causing failure to perfect

1st Source Bank vs. Wilson Bank & Trust (Tennessee)

The creditor, CCF Leasing Company, filed a UCC-1 statement but listed the debtor as “Wing Fine Food”. Because a UCC search using the secretary of state’s search logic would not have produced the financing statement, the court found the filing to be fatally flawed and Wing Foods, Inc. was able to avoid the creditor’s security interest claim.

Ref: NCS Credit blog 11/12/2014

But I don’t have time to go to the Secretary of State!

But I don’t have time to go to the Secretary of State!

Due to the detailed requirements of filing (including notification, most creditors prefer to use a qualified service, such as NACM’s MLBS.

Due to the detailed requirements of filing (including notification), most creditors prefer to use a qualified service. However, if you wanted to file a financing statement on your own, you must first make sure you have all the proper documents. You would then submit these documents to the central filing office in the state the debtor resides or its business is registered. This is commonly done electronically. Each state has its own rules for filing so further research must be done in order to ensure full compliance to that state’s requirements.

Required documents to file a financing statement:

UCC1-UCC Financing Statement – this is a Unified Commercial Code form prepared by the company granting credit. When it is filed appropriately it gives public notice that a creditor has a security interest in collateral belonging to the customer documented in the statement. The financing statement must be filed with the office of the appropriate government agency, generally the office of the Secretary of State of the buyer’s location.

Sample of UCC1 Template

How do I know my filing is complete?

Upon request at the filing office, you can obtain notification of acknowledgement when the filing is complete. A specific number is assigned to each UCC filing for identification and will be provided with the requested acknowledgement. This number is referred to as the file number. Furthermore, the date and time of the filing is critical given the hierarchy of security interests by date.

Remember!

First in line, first in right—except for PMSI filings!

Therefore, the date and time will be recorded with each filing as well.

The filing office where the documents were submitted is the place that maintains the records of the financing statement and any attached documents. At least annually all states must review their filing-office rules to ensure compliance and effectiveness.

A creditor can search for records of financing statements by the debtor name or file number if they know it.

A filing can be refused for several reasons, like when it is not received properly (must be original document), the filing fee isn’t paid, an incomplete or invalid name for debtor or does not have attaching and complete financing statement. However, the filing office must communicate the refusal within two business days from receiving the record. Method of communication depends on the state requirements. Each state also has statutory requirements of holding public record documents that would dictate when they can destruct written records of financing statements.

What are the rules of priority and are there ways to obtain priority over existing creditors?

It is important for the creditor to know the rules of priority and determine the steps necessary to ensure that he is protected. Remember that the UCC -1 must be filed – your security agreement is worthless until the filing is complete. In most cases, if there is bank financing, they will usually have a perfected blanket UCC -1 that takes priority. This why it is important to do a thorough search of all prior filings to determine the effectiveness of your filing.

Rules of Priority:

- Determined by the time of filing or perfection – the first filed has the first right

- It includes both proceeds and the supporting obligations of the collateral

- Perfected interests can be subordinated (see PMSI) with the permission of prior secured parties

Can I secure future shipments that will take priority over existing security interests?

As indicated earlier, many times a bank or other secured lender will have a blanket UCC-1 that gives it priority interest in all inventory and proceeds of the debtor. However, there is way to secure goods and proceeds before they are shipped. This is done through a Purchase Money Security Interest (PMSI). A PMSI grants a security interest to the trade creditor sold on credit terms for the price of the goods sold.

A key advantage gained by a PMSI is that it gives the creditor access to co-mingled funds not specifically identifiable by the creditor or the courts.

Rules and requirements:

- Only covers goods and proceeds sold on credit terms moving forward – does not cover existing debt.

- The debtor must agree and sign off

- Must describe in detail the goods or inventory that is covered

- Always do a UCC search to determine existing secured parties

- The secured party (most often a bank) must be notified and grant a priority for the good s or proceeds of the creditor prior to the debt being incurred. This is called a subordination. It is usually not granted unless the secured party determines that it is in their best interest and provides the potential for additional income and profits.

- Must be filed and recorded once completed and signed.

- The PMSI is perfected once the debtor takes possession of the inventory

- You must send official notification to the holder of the prior security interest prior to debtor taking possession

Sample Purchase Money Security Interest

SAMPLE PURCHASE MONEY SECURITY INTEREST

How do I enforce my security interest once it is in place?

A security interest attaches to collateral and becomes enforceable if:

- value has been given

- the debtor has rights in it and/or the authority to transfer rights to a secured party.

AND if any of a number of conditions are met, one being:

- an authenticated security agreement giving a description of the collateral is completed

What happens if my customer (debtor) defaults?

Secured Creditors in Action!

Assuming that you have filed all of the necessary paperwork and perfected your security interest, there may come a time when a customer defaults on the agreement. At that point there are several options available to you to enforce your lien against the collateral.

Three things you can do:

- Foreclose on the collateral

- Claim a judgment against your customer

- Enforce a claim against your customer in court

As a creditor you may deduct reasonable attorney fees and collection expenses incurred during the repossession of your collateral.

As a creditor you can sell, lease, license, or otherwise dispose of any or all of the collateral covered by the security agreement as long as it is reasonable to both parties. If you are going to dispose of the collateral, you must send notification to the customer and any secondary lien holder unless they waive their right to the disposition of the collateral. In most cases a 10-day notice is sufficient.

All proceeds that are received over and above any debt owed must be returned to the customer or to a subordinate security interest holder. The customer would still be liable for any deficiency amount that is owed after the collateral is seized.

Upon default you may require your customer to assemble the collateral and make it available to you at a place of your choosing and is convenient for both you and your customer.

Notice of disposition should include a description of the collateral to be sold, leased, or licensed, the method of disposition, charges associated with the sale or disposition, and time and place of the disposition.

Example:

We will sell (lease or license) the following collateral privately sometime after this date. You are entitled to an accounting of the unpaid indebtedness secured by the property that we intend to sell (lease or license) for the amount of $_______. You may request an accounting by call us at (telephone #).

For a consumer goods transaction:

Name and address of creditor and date

Example: Notice of our plan to sell property

Name and address of debtor

Identification of collateral

We have your collateral and because you broke promises in our agreement we will sell (description of collateral) at a private sale sometime after (date). The money that we get from the sale (after paying our costs) will reduce the amount that you owe. If we get less money than you owe, you will still be responsible for the difference. If we get more money than you owe, you will get the excess unless there is a secondary lien holder. You can get the property back at any time before we sell it by paying us the full amount you owe, including our expenses. For a balance owed please call us at (telephone #). We are also notifying other individuals who may have an interest in this collateral or who owe money under your agreement. (List names of other possible lien holders if any).

Acceptance of collateral in full or partial satisfaction of the obligation can be done only at the debtor’s consent within 20 days of notification. This does not require you as a creditor to dispose of the collateral (Does not apply to consumer transactions)

In consumer transactions collateral must be disposed of within 90 days after taking possession or within a longer period to which the customer and secondary lien holders have agreed to.

The customer or a secondary lien holder has the right to redeem the collateral for full payment of the obligation at any time prior to disposition.

Default—Mistakes can be costly!

Sports Authority Bankruptcy and Implication on UCC Consignment deals:

Sports Authority initially filed Chapter 11 bankruptcy to reorganize its structure and become a much smaller retailer of sports merchandise and clothing. However, in the midst of the initial bankruptcy proceedings the creditors became aware that Sports Authority was listing inventory as an asset when the inventory was in fact part of consignment deals and therefore not assets of Sports Authority but still assets of suppliers (creditors). This critical issue forced Sports Authority into Chapter 7 bankruptcy because it had been overstating its assets and blurring the true financial disarray it was in.

During the bankruptcy the court ordered Sports Authority to start liquidating its assets which caused an argument over the proceeds of the sale of consignment items. Should the proceeds go lenders with secured interests in Sports Authority or go directly back to the suppliers with the consignment agreements that claimed they still owned the items up for sale in the liquidation?

Alas, the crux of the issue acknowledged that had the suppliers protected their consignment agreements by perfecting a security interest and notifying lenders to not use the consignment goods as collateral in their security interests of Sports Authority. This is a critical part of UCC Article 9 and important for all creditors to be aware of in their dealings of consignment issues.

Ref: www.bloomberg.com/

What Should You Remember?

-

The purpose of Article 9

For creditors to gain a security interest in personal property (assets) of a customer which may elevate their position in collections

-

Security agreement = security interest

Must have identification of parties, granting clause and collateral (asset) description

-

No UCC-1 = Not perfected = Not a secured creditor

To become a secured creditor à perfect security interest by filing a UCC-1 with the proper filing clerk

-

With a perfected interest a secured creditor has:

- Right of repossession of the asset

- Elevated priority in bankruptcy

- Defense to preference in bankruptcy

-

Mistakes are costly

Always review your work for accuracy. Utilize a third party for additional verification to confirm all steps are complete.

Glossary

Attachment – when a security agreement is executed and the debtor acquires right in the assets subject to the security interest (collateral). The creditor’s security interest becomes enforceable.

Collateral – property subject to a security interest. Laws vary regarding various types of collateral and the legal jurisdiction. Typical personal property involved in a security interest includes inventory, fixtures, equipment, vehicles, accounts receivable, and stocks/bonds/ negotiable instruments. It cannot be real property.

Control – Control of collateral does not mean the same thing as possession of collateral. See UCC Article 9 parts 1 and 2.

Lien – official claim an asset for payment of a debt or an amount owed by a buyer. It is usually a formal document signed by the credit provider and sometimes by the buyer who agrees to the amount due.

Perfection – a legal process by which a secured creditor can protect itself against claims of other third parties who wish to have their debts satisfied out of the same debtor collateral

Possession – with respect to collateral, possession is the control a person intentionally exercises toward that collateral. To possess collateral, a person must have an intention to possess it. A person may be in possession of an asset but that does not imply ownership.

Priority – where your perfected claim falls with respect to other creditors; what is the legal order of collateral disposition

Security Agreement – the debtor agrees to specific points that govern the lien, e.g. collateral and the nature of the debt obligation

Security Interest – an interest in in a customer’s personal assets to secure the repayment of its debt

Purchase Money Security Interest – a specific type of security interest that enables an entity that provides financing for the acquisition of goods or equipment to obtain priority ranking ahead of other secured creditors.

UCC 1 Financing Statement – a UCC form prepared by company granting credit. When it is filed appropriately it gives public notice that a creditor has a security interest in collateral belonging to the customer documented in the statement.