Financial Statement Analysis 2: Credit and Risk Assessment

Financial Statement Analysis 2: Credit and Risk Assessment

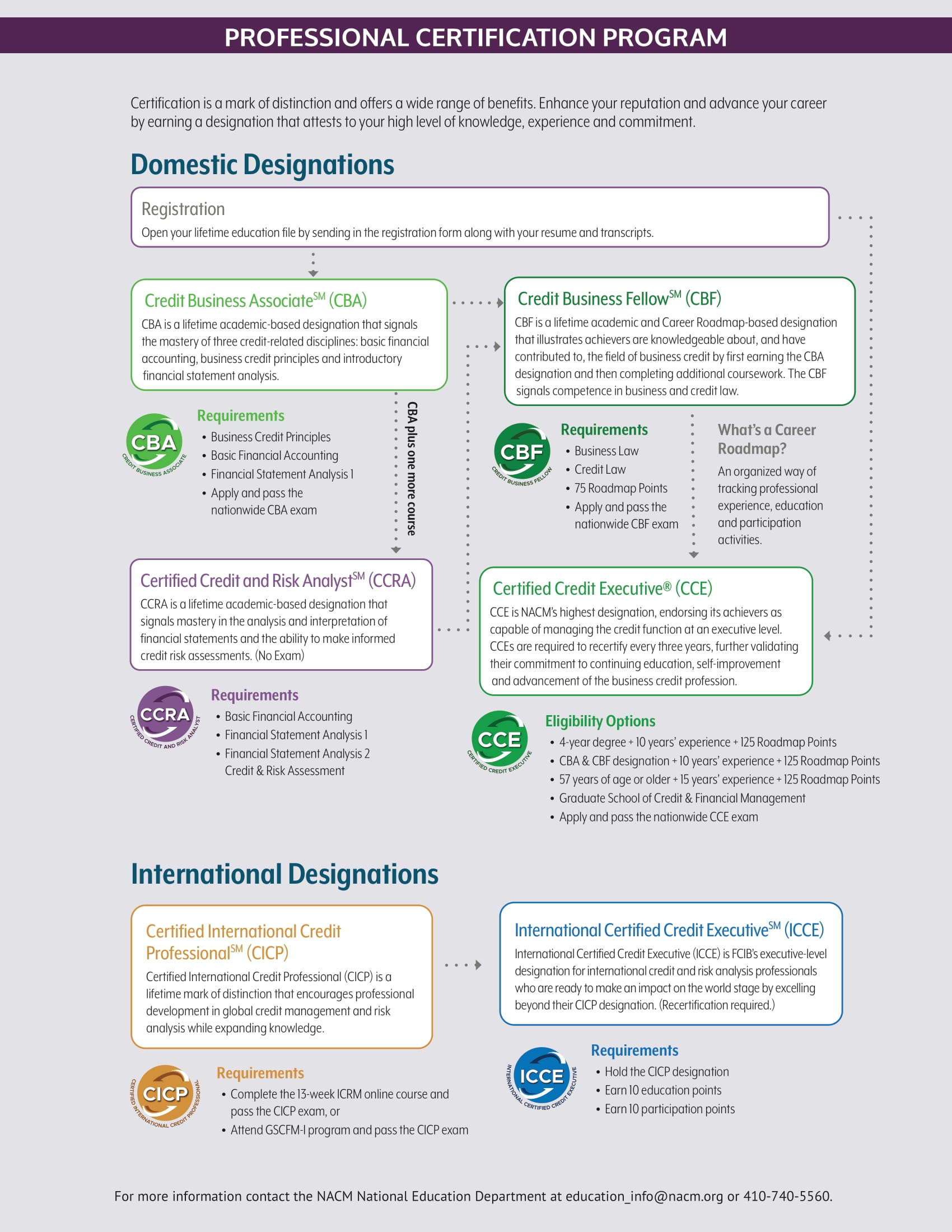

A course for credit & risk analysts, CCE exam candidates and those striving to earn the new NACM Certified Credit & Risk Analyst (CCRA) certification

About the Program

This intermediate financial analysis program has been designed for credit analysts, risk analysts and managers seeking comprehensive understanding of what's behind the numbers in financial reports. It is designed to improve the credit & finance professional's ability to analyze and interpret financial statements leading to quality credit risk assessment. The program gives equal weight to the process of financial reporting, the analysis and interpretation of financial statements and the steps required to document a quality credit line recommendation.

Program OverviewThis course is an excellent preparatory class for the Certified Credit Executive (CCE) designation exam. Using the textbook, Financial Reporting and Analysis - Custom Edition, by Charles H. Gibson, participants will receive in-depth exposure to:

Program PrerequisitesIt is strongly recommended that participants have successfully completed a basic financial accounting course. In order to participate actively and gain the most from this course, students will need to join this class with a firm understanding of accounting concepts. Also, it is recommended that Financial Statement Analysis 1 be completed prior to this course. |

Program Instructor

With 46 years of Finance and Credit experience, he has implemented various management tools to improve Credit, Risk Assessment, Billing & Dispute Management processes, eliminating numerous routine repetitive tasks performed by credit personnel. Mr. Schnupp is a certified instructor at the National Association of Credit Management. He has taught Principles of Business Credit, Basic Financial Accounting 101, Financial Statement Analysis I, Financial Statements Analysis II (Intermediate): Interpretation and Credit Risk Assessment and Essentials of Finance. He is a graduate of the NACM Graduate School of Credit & Financial Management held on the campus of Dartmouth University. He has authored the course material for the CCE Prep Course that is offered at Credit Congress. He is also a core contributor to the “Principles of Business Credit” book used in the Credit Administration Program. Mr. Schnupp has served on five National Committees: Editorial Committee for the Business Credit Magazine, National Accreditation Committee, National Education Committee, National Credit Administration Program Committee, and is the Chairman of the National Advanced Credit Administration Program Instructors Committee. He was also named the NACM and Robert Half/Account-temps Instructor of the Year. George has been the recipient of the NACM/Midwest Credit Executive of the Year award. Mr. Schnupp is dedicated to community and citizenship through his volunteer work. He continues to annually support Junior Achievement, Red Cross, Feed My Starving Children, and the Habitat for Humanity. He has also with honor mentored many of our certification recipients over the last four decades. |

General Information

General Information

The Certificate Sessions are conducted at the NACM headquarters located in Columbia, Maryland.

Find out how you can complete an NACM Certification Program requirement in one week.

Program Schedule

Day One

Day One – Monday

8:00 – 8:30am

Continental Breakfast

8:30am – 10:30am

Chapter 1: Introduction to Financial Reporting

You will learn the basic principles of accounting on which financial reports are based. A review of the evolution of GAAP and the traditional assumptions of the accounting model helps the participant understand the statements and thus analyze them better.

10:30 – 10:45am

Morning Break

10:45am to 12 noon

Chapter 2: Introduction to Financial Statements and Other Financial Reporting Topics

You will learn the forms of business entities and be introduced to financial statements. This chapter includes other financial reporting topics that contribute to the understanding of financial reporting, such as the auditor's report, management's responsibility for financial statements and the SEC's integrated disclosure system.

Noon – 1:00pm

Lunch

1:00 – 3:00pm

Chapter 3: Income Statement

You will learn all about the operating statement: revenues, expenses, gross margins, operating margins, net profit margins and special income statement items.

3:00 – 3:15pm

Afternoon Break

3:15 – 5:00pm

Chapter 4: Balance Sheet

You will learn all about the balance sheet and be introduced to consolidated statements and problems in balance sheet presentation. Special emphasis will be given to the investment choices in various assets being employed on the balance sheet.

5:30pm

Dinner at a Local Restaurant

All dinners are held at restaurants. A variety of dinner choices is always available.

Day Two

Day Two – Tuesday

8:00 – 8:30am

Continental Breakfast

8:30 – 10:30am

Chapter 5: Liquidity of Short-Term Assets; Related Debt-Paying Ability

You will learn about the procedures necessary for analyzing short-term assets and the short-term debt-paying ability of an entity. There will be a detailed discussion of four very important current investments: cash, marketable securities, accounts receivable and inventory.

10:30 – 10:45am

Morning Break

10:45am – Noon

Chapter 6: Long-Term Debt-Paying Ability

You will two approaches to viewing a firm's long-term debt-paying ability. One approach views the firm's ability to carry the debt as indicated by the income statement, and the other considers the firm's ability to carry debt as indicated by the balance sheet

Noon to 1:00pm

Lunch

1:00 to 3:00pm

Chapter 4: Frazier Book – Statement of Cash Flow

You will learn the major sources and uses of cash reported in the operating, investing and financing sections of the statement of cash flows. You will also learn why accrual net income and operating cash flows differ and the factors that explain this difference. The difference between the direct and indirect method of determining cash flows from operations will be discussed. You will learn how to prepare a statement of cash flows from comparative balance sheet data, an income statement and other financial information. Special emphasis will be given to the operating activities related to working capital.

3:00 – 3:15pm

Afternoon Break

3:15 – 5:00pm.

Chapter 7: Statement of Cash Flows

Analyze and interpret all three activities in the Cash Flow Statement.

5:30pm

Dinner at a Local Restaurant

Day Three

Day Three – Wednesday

8:00 – 8:30am

Continental Breakfast

8:30 – 10:30am

Chapter 8

You will learn how competitive forces and a company's business strategy influence its operating profitability. You will also learn how Return on Assets (ROA) can be used to analyze a company's operating profitability and what insights are gained from separating ROA into its profit margin and asset turnover components. Return on Equity (ROE) will also be studied to determine the impact of financial leverage on a company's operating profitability.

Appendix A

Margins, Turnover, Leverage & Liquidity

Appendix B

The Decision to Sell

10:30 – 10:45am

Morning Break

10:45am – Noon

Appendix C

Analysis What Now?

Appendix D

Return on Equity: Documenting Credit Risk

Appendix E

Methodology of Financial Statement Analysis

Noon – 1:00pm

Lunch

1:00 – 3:00pm

Appendix F

Accounting Profits versus Cash Profits

Appendix G

Roll for Margins, Turnover & Leverage

Case #1

Comprehensive Review

3:00 – 3:15pm

Afternoon Break

3:15 – 5:00pm

Case (continued)

5:00pm

Study Session and Pizza Dinner

Case #2

Comprehensive Review

Day Four

Day Four – Thursday

8:00 – 8:30am

Continental Breakfast

8:30 – 10:00am

Review both Case Studies

10:00 – 10:15am

Morning Break

10:15am – Noon

Case Studies

Stock Performance

Noon – 1:00pm

Lunch

1:00 – 5:00pm

Evaluations & Final Exam

In order to give you sufficient time to take the final exam, we strongly recommend that your return flight be scheduled to depart after 5:00pm on the final day of the program or the following morning. Please do not plan on leaving the national office for the airport before 5:00pm.

George A. Schnupp, CCE, ALB, ALC retired in December 2023. He was previously the Director, Global AR Operations at WESCO International, Inc., which is a leading global supplier of communications and security products and electrical and electronic wire and cable. WESCO helps customers specify solutions and make informed purchasing decisions around technologies, applications, and relevant standards. On July 29, 2011, Mr. Schnupp was awarded with the most prestigious Anixter recognition, “The 2010 Award of Excellence.” In June of 2011, he also received two professional designations from Toastmasters International where he earned his Advanced Leader Communicator & Advanced Leader Bronze Awards. In May 31, 2019, he earned his third Toastmasters International professional designation Effective Coaching Award. In 2008, Mr. Schnupp was also the recipient of National Association Credit Managements "National Executive of the Year" Award.

George A. Schnupp, CCE, ALB, ALC retired in December 2023. He was previously the Director, Global AR Operations at WESCO International, Inc., which is a leading global supplier of communications and security products and electrical and electronic wire and cable. WESCO helps customers specify solutions and make informed purchasing decisions around technologies, applications, and relevant standards. On July 29, 2011, Mr. Schnupp was awarded with the most prestigious Anixter recognition, “The 2010 Award of Excellence.” In June of 2011, he also received two professional designations from Toastmasters International where he earned his Advanced Leader Communicator & Advanced Leader Bronze Awards. In May 31, 2019, he earned his third Toastmasters International professional designation Effective Coaching Award. In 2008, Mr. Schnupp was also the recipient of National Association Credit Managements "National Executive of the Year" Award. Financial Statement Analysis (FSA1) is a method of interpreting accounting data in an effort to understand the current financial performance of an entity and project its future health. FSA1 keeps the evaluation process simple, but requires a working knowledge of basic accounting principles. The emphasis of the course is on analyzing financial statements issued by companies using fundamental ratio analysis techniques and analysis of the statement of cash flows. These evaluations can be used to determine the operating efficiency, profitability and financial risk of a firm.

Financial Statement Analysis (FSA1) is a method of interpreting accounting data in an effort to understand the current financial performance of an entity and project its future health. FSA1 keeps the evaluation process simple, but requires a working knowledge of basic accounting principles. The emphasis of the course is on analyzing financial statements issued by companies using fundamental ratio analysis techniques and analysis of the statement of cash flows. These evaluations can be used to determine the operating efficiency, profitability and financial risk of a firm.

Toni Drake, CCE is the President of TRM Financial Services, Inc., a company specializing in consulting and outsourcing services in the area of business credit and collections. Ms. Drake launched The Connection Center in 2005, which focuses on training and education in credit and collections, including financial statement analysis, as well as in the areas of professional development. Ms. Drake has been a member of NACM since 1984, and began teaching CAP classes and various educational sessions in 1997. Ms. Drake served as the NACM National Chair of the Board in 2013. She is an alumni of the NACM Graduate School of Credit and Financial Management at Dartmouth College. She was awarded the Credit Executive of the Year Award by NACM-Southwest and was awarded the CCE Designation of Excellence Award by NACM National in 2008.

Toni Drake, CCE is the President of TRM Financial Services, Inc., a company specializing in consulting and outsourcing services in the area of business credit and collections. Ms. Drake launched The Connection Center in 2005, which focuses on training and education in credit and collections, including financial statement analysis, as well as in the areas of professional development. Ms. Drake has been a member of NACM since 1984, and began teaching CAP classes and various educational sessions in 1997. Ms. Drake served as the NACM National Chair of the Board in 2013. She is an alumni of the NACM Graduate School of Credit and Financial Management at Dartmouth College. She was awarded the Credit Executive of the Year Award by NACM-Southwest and was awarded the CCE Designation of Excellence Award by NACM National in 2008.

When you apply to participate in the

When you apply to participate in the