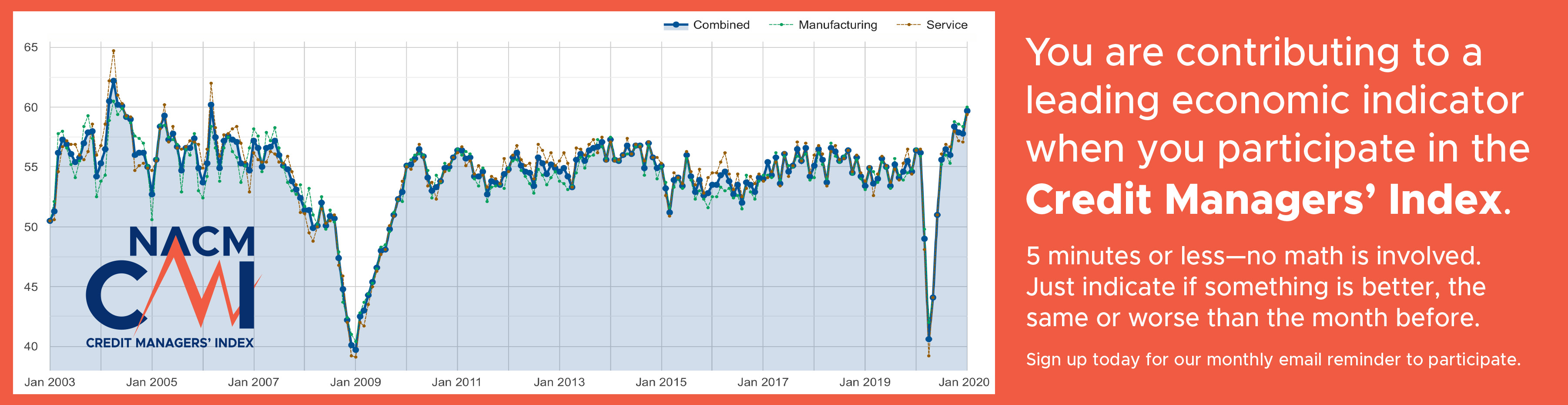

November’s economic report from the National Association of Credit Management continues its roller coaster ride, dropping from 53.9 to 52.6.

Both the manufacturing and service sectors experienced a decline this month, according to the November report of the from the National Association of Credit Management (NACM). The combined CMI index dropped more than a point, from 53.9 in October to 52.6 in November.

“This month, the trend has returned to the stress of the last few, and the timing is not as it should be,” explained NACM Economist Chris Kuehl, Ph.D. “This is the time of year that the consumer comes to the rescue, but it doesn’t appear that will happen this time.”

The respective favorable and unfavorable index factors in NACM’s combined CMI both dropped from the previous month. Every subcategory within these indexes also declined, with four out of six unfavorable categories in contraction territory. “Given all the data that has been emerging as far as the economy’s overall strength, this is not a big surprise, but still a disappointment,” Kuehl noted. “It seems that companies are struggling at this point in the year and that is not a good sign given that this is the time when these companies are expected to make the bulk of their money for the year. This really applies mostly to retail, but the manufacturers respond to that retail drive.”

For a full breakdown of the manufacturing and service sector data and graphics, view the complete November 2015 report here. CMI archives may also be viewed on NACM’s website here.

ABOUT THE NATIONAL ASSOCIATION OF CREDIT MANAGEMENT

NACM, headquartered in Columbia, Maryland, supports more than 15,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of affiliated associations are the leading resource for credit and financial management information, education, products and services designed to improve the management of business credit and accounts receivable. NACM’s collective voice has influenced federal legislative policy results concerning commercial business and trade credit to our nation’s policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy. NACM's annual Credit Congress & Exposition conference is the largest gathering of credit professionals in the world.

Contact: Diana Mota, Associate Editor, 410-740-5560, This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.nacm.org

Source: National Association of Credit Management