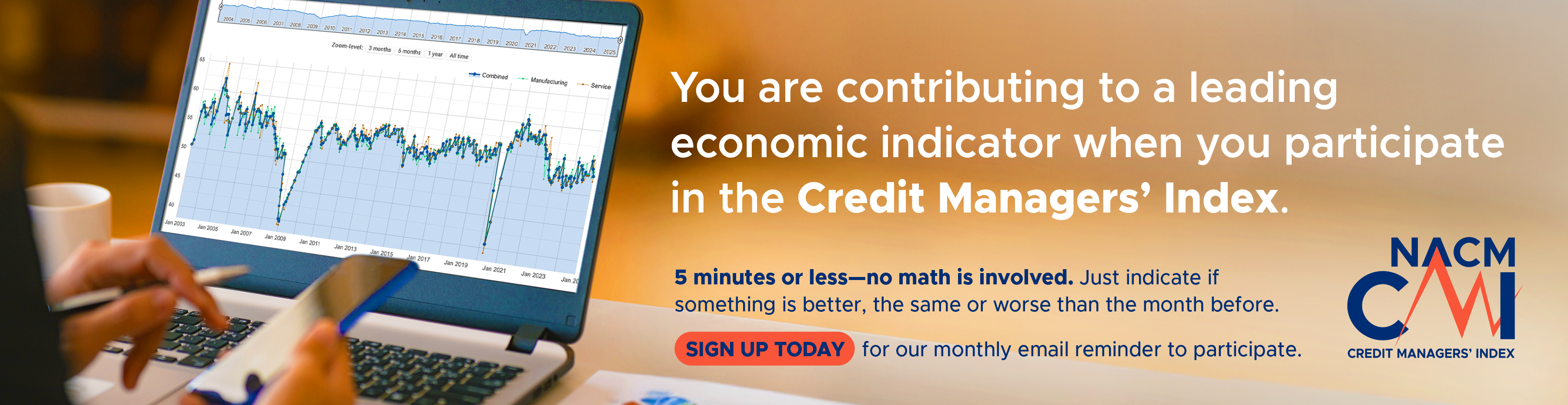

The July economic report of NACM’s Credit Managers’ Index from NACM shows a turnaround from the previous month’s trends.

Mirroring the volatility in the economy, the July report of the Credit Managers’ Index (CMI) from the National Association of Credit Management (NACM) saw some factors gain while others declined.

“We saw job creation numbers crash to levels not seen since the recession in May and jump back to nearly record levels in June,” noted NACM Economist Chris Kuehl, Ph.D. “The latest durable goods numbers are down due to the reduction in export activity, but the housing sector is showing more strength than it has since before the downturn. Now we see some of that back and forth in the CMI data as well.”

The combined (manufacturing and service sectors ) score regained some momentum in July and is now at 53.5 after having been down to 52.7 last month. Most of the extreme activity, however, is seen in the various subcategories. The combined index of favorable factors improved enough to get back into the 60 range where it has been three times in the past year. Its strength shows up in growth through all four of its categories, which are in the high 50s or low 60s. This is a trend that needs to continue if there is to be any progress in the economy overall.

The combined index of unfavorable factors showed more distress as this is the second-consecutive month with a sub-50 reading. Of the six subcategories, only two, rejections of credit applications and filings for bankruptcies, are above the line (50) that divides contraction from expansion.

Concerning credit applications, Kuehl commented, “the fact that applications are up but approvals are down indicates that there are more companies in trouble and hoping they find a supplier that will give them credit regardless. There are not that many gullible companies out there these days; and therefore, there are more rejections.”

As for the other four unfavorable categories, they are hovering below 50. Volatility is evident as shown in both the favorable and unfavorable indexes of all categories with the first trending upward and the other downward in each case.

For a full breakdown of the manufacturing and service sector data and graphics, view the complete July 2016 report here. CMI archives may also be viewed on NACM’s website here.

ABOUT THE NATIONAL ASSOCIATION OF CREDIT MANAGEMENT

NACM, headquartered in Columbia, Maryland, supports more than 15,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of affiliated associations are the leading resource for credit and financial management information, education, products and services designed to improve the management of business credit and accounts receivable. NACM’s collective voice has influenced federal legislative policy results concerning commercial business and trade credit to our nation’s policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy. NACM's annual Credit Congress & Exposition conference is the largest gathering of credit professionals in the world.

Contact: Diana Mota, Associate Editor, 410-740-5560, This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.nacm.org

Source: National Association of Credit Management